Why Automation Testing is Important in FinTech

FinTech applications handle massive amounts of sensitive financial

data and real-time transactions. Any software error can lead to financial losses,

data breaches, or compliance issues. The fast-paced development cycles and the

demand for quick delivery of new features also create challenges in maintaining

software quality.

Here are some reasons why automation testing is essential

in FinTech:

Complexity of FinTech Applications

FinTech applications are multifaceted, involving numerous processes like

transactions, payments, lending, wealth management, and more. Each of these

functions must interact seamlessly to provide users with a secure and flawless

experience. Manual testing, although necessary at times, cannot keep up with the

complex nature of these applications. This is where automation testing services

excel.

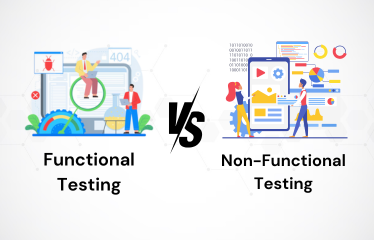

Automation testing provides scalability, allowing FinTech companies to test multiple

processes and transactions in parallel. With automated scripts, a wide range of

tests—such as functional, regression, performance, and security tests—can be run

simultaneously, ensuring that the application operates efficiently even under heavy

load.

Regulatory Compliance

One of the key challenges for FinTech companies is ensuring compliance with

stringent regulatory requirements. Any failure to comply can result in hefty fines,

loss of reputation, and legal challenges. Automated tests can be tailored to verify

compliance with specific regulations like PSD2 (Payment Services Directive), GDPR

(General Data Protection Regulation), and other country-specific financial

regulations.

Through continuous integration and deployment, automation testing allows FinTech

companies to identify and address compliance issues early in the development cycle.

This approach reduces the risk of non-compliance and ensures that new updates or

releases do not introduce regulatory breaches.

Security Concerns in FinTech

Security is paramount in the FinTech industry. With applications handling sensitive

data such as personal information and financial transactions, any security breach

can lead to massive losses and damage to the brand's credibility. Automated security

testing helps to detect vulnerabilities, weak points, and potential threats that

manual testing might miss.

Automation testing in FinTech can simulate various cyberattack scenarios, ensuring

that the application has robust defenses in place. By incorporating security tests

into the automation pipeline, FinTech companies can identify potential

vulnerabilities before they can be exploited.

Security Concerns in FinTech

Security is paramount in the FinTech industry. With applications handling sensitive

data such as personal information and financial transactions, any security breach

can lead to massive losses and damage to the brand's credibility. Automated security

testing helps to detect vulnerabilities, weak points, and potential threats that

manual testing might miss.

Automation testing in FinTech can simulate various cyberattack scenarios, ensuring

that the application has robust defenses in place. By incorporating security tests

into the automation pipeline, FinTech companies can identify potential

vulnerabilities before they can be exploited.

Continuous Testing in Agile and DevOps

The agile methodology is widely used in FinTech, where continuous delivery and

deployment are crucial. Automation testing seamlessly integrates into the CI/CD

(Continuous Integration/Continuous Deployment) pipeline, allowing for continuous

testing. This ensures that any updates, new features, or bug fixes are thoroughly

tested in real-time without interrupting the delivery flow.

Continuous Testing in Agile and DevOps

The agile methodology is widely used in FinTech, where continuous delivery and

deployment are crucial. Automation testing seamlessly integrates into the CI/CD

(Continuous Integration/Continuous Deployment) pipeline, allowing for continuous

testing. This ensures that any updates, new features, or bug fixes are thoroughly

tested in real-time without interrupting the delivery flow.

Cost and Time Efficiency

Manual testing is both time-consuming and costly. It requires significant manpower

to test large and complex applications, often resulting in human errors and delays.

Automation testing, on the other hand, allows for the repetitive execution of tests

without human intervention, saving both time and money. Once automated test scripts

are created, they can be reused across multiple test cycles, significantly reducing

the testing time for future updates.

Enhanced Customer Experience

FinTech applications are customer-centric, with user experience being a key

differentiator. Automation testing ensures that every element of the application

works flawlessly, from mobile apps to web interfaces. Performance

testing, for

example, can verify that the app functions efficiently under different network

conditions, ensuring a seamless experience for users regardless of where they are

located.

Furthermore, automation allows for continuous testing and monitoring of

applications, making sure that any performance or usability issues are caught early

and fixed before they can impact customers.